How VISA Fees are Calculated?

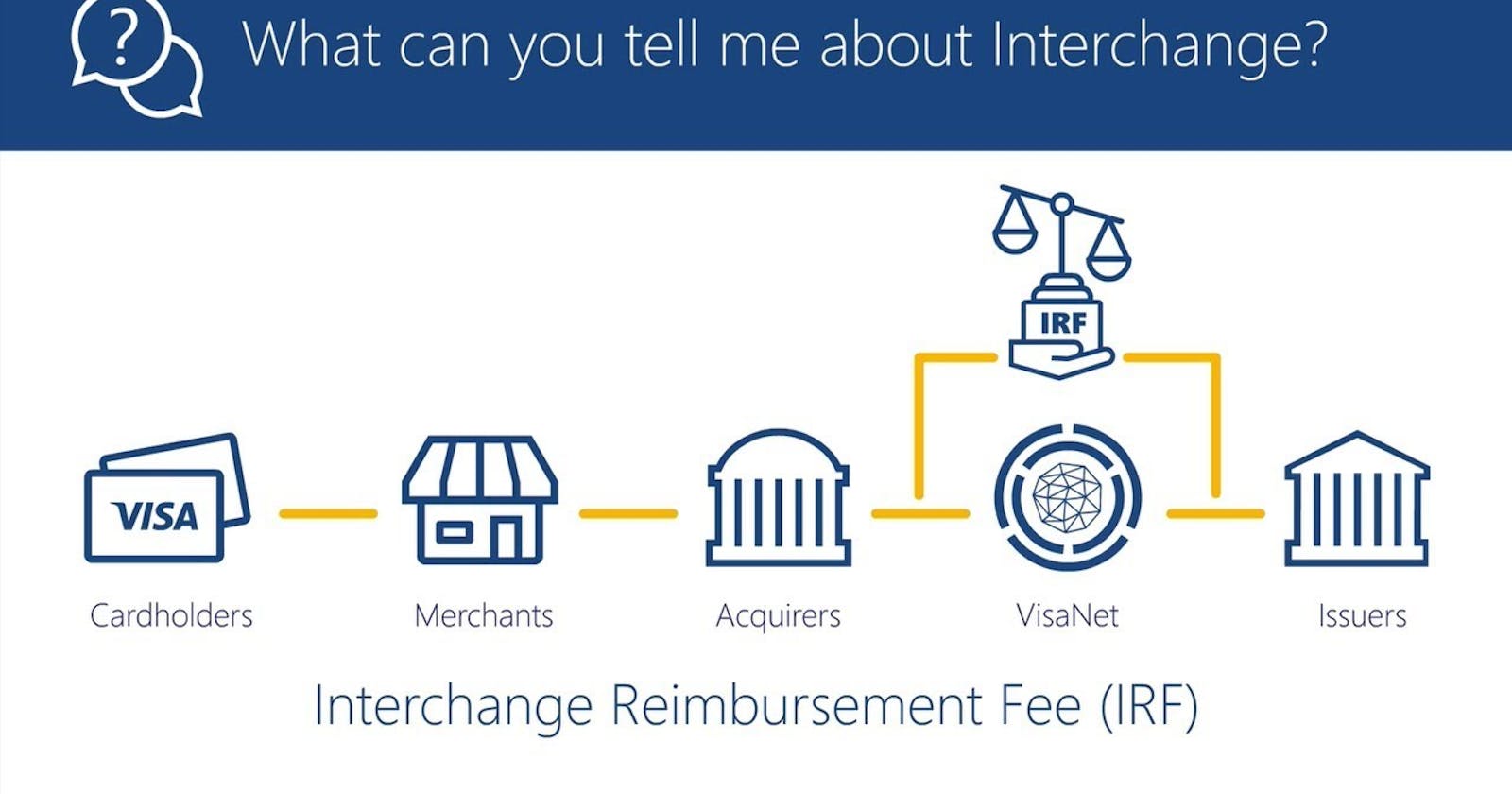

IRF - Interchange Reimbursement Fee (between Acquirers and Issuers)

- Acquirer pays the issuer for each cardholder purchase

- In return Acquirer receive guaranteed funds from issuer, which enables the Merchnat to close a sell even if the cardholder has not yet actually paid

Question 01: How IRF is calculated?

- Based on a percentage of the transaction amount which may also include a flat per item fee as well

Question 02: Why does the IRF rate vary from transaction to transaction?

- IRF varies because of the unique business and processing requirements of transaction

- IRF vaires by

- the type of merchant

- the cost of sell

- the payment product used

- processing technology the merchant uses

- and region and country

- Additionally Risk Can be a driver at IRF rate (i.e. interchange fees are often higher for Credit Card then Debit Card)

Question 03: Is IRF is a VISA Fee?

- No, IRF is not a VISA Fee. VISA's role is to facilitate the transfer of IRF

Question 04: So does VISA charge any fees for its services?

- Yes, VISA changes fees

- The data processing fees to both the Issuer and Acquirers for transaction

Question 05: Are there any other Fees?

- The acquirer charges the merchant a fee called the merchant discount rate, this fee covers the acquirees processing services on merchant's debit and credit card transactions

Example: $100 Pruase using VISA Debit Card Assume, IRF rate is 0.5% Merchant Discount Rate: 80 cent

Merchant Acquirers Issuers Remains 0.50 (IRF) 99.50 98.70 (0.80 M.Discount) 98.70

98.70 (Acquirer deposit $98.70 (guaranteed) at the merchant account at the sell cycle)